Did you acquire Atos shares between February 2018 and March 2024?

Join the Action Against Atos Auditors (the “Action”), a coordinated legal action brought by a group of shareholders represented by the law firm Vermeille & Co, with the aim of obtaining compensation for the losses suffered due to their investment in Atos shares.

You do not have to pay any fees to participate in the Action.

The conduct of the Action is financed by a litigation fund for all investors participating in the Action.

Accordingly, all procedural costs related to the Action (legal fees, expert fees, court costs, etc.) are covered by the litigation fund that has agreed to finance the Action.

This financing is governed by the following terms:

- In the event of a successful outcome: a commission will be deducted by the fund from the amount of the gains obtained, which will include a success fee for the law firm Vermeille & Co;

- In the event of an unsuccessful outcome: all the procedural costs paid by the fund will remain entirely at its expense.

What is the Action about?

The Action Against Atos Auditors is a civil liability action brought against Atos’ statutory auditors, namely Deloitte & Associés and Grant Thornton.

They are alleged, in particular, to have :

- Certified the consolidated financial statements of Atos for several financial years, even though those statements did not reflect the true financial and asset position of the Atos group ;

- Failed to issue a going concern warning despite the company’s deteriorating financial situation; and

- Thus contributed to the dissemination of false or misleading information that misled investors.

The objective of the Action is to obtain compensation for the losses suffered by investors due to their investment in Atos shares during the period from February 2018 to March 2024.

What are the advantages of the Action?

The Action Against Atos Auditors is a coordinated legal action, funded by a third party, that offers several key advantages:

- Financial advantage: the claimant does not have to pay out the procedural costs incurred for the defense of their interests and does not bear these costs in the event the Action is unsuccessful.

- Technical advantage: the case is handled by an experienced law firm, assisted by experts in audit and accounting, as well as in the assessment of stock market losses.

- Strategic advantage: a coordinated action allows individuals and small businesses to pool their resources in order to bring proceedings against large corporate entities.

.png?width=420&height=560&name=Untitled%20(300%20x%20400%20px).png)

Understanding the Atos Case

The collapse of the Atos group

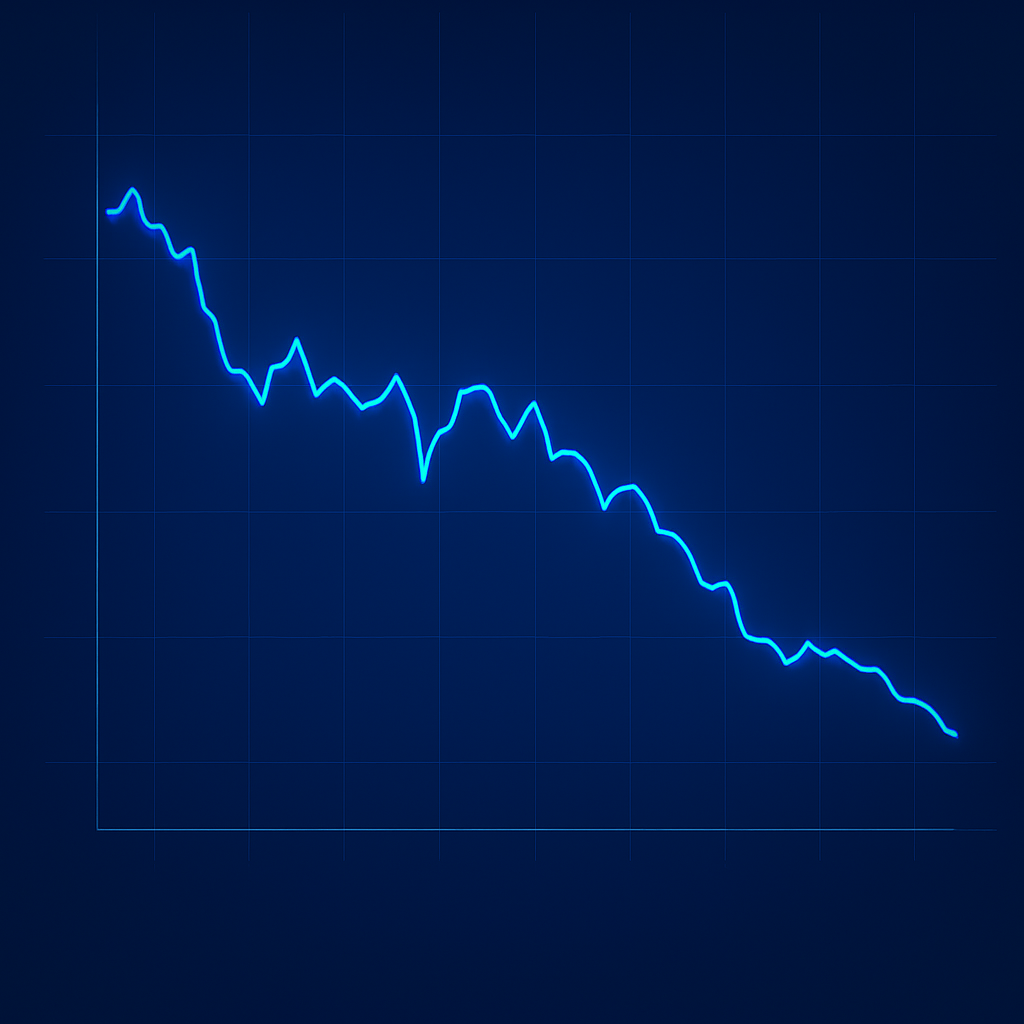

Between April 2021 and April 2024, the price of Atos shares fell from 70 euros to less than 1 euro. As a result, many investors suffered significant financial losses.

This collapse in Atos’s share price is all the more striking given that Atos was one of the leading IT services companies in Europe, a sector known for its stability and growth potential, and was part of the CAC 40 index until September 2021.

Questioning the quality of financial information

Our accounting and financial analyses indicate that Atos’ consolidated financial statements did not reflect the group’s true economic and financial situation for several financial years, even though these financial statements were certified by Atos’ statutory auditors, Deloitte & Associés and Grant Thornton.

.jpg)

Prior to the commencement of its financial restructuring, Atos’s market capitalization had already collapsed to near zero

The loss suffered by investors

The false or misleading financial information had the effect of maintaining the price of Atos share at an artificially high level, disconnected from the group’s actual economic reality.

Many investors may have made investment decisions based on erroneous information, which may have caused them significant financial loss.