FAQ

1. What is the Action about?

The Action Against Atos Auditors is a legal action brought by shareholders of Atos SE (“Atos”) before the French civil courts (at first instance before the Commercial Court), seeking to hold Atos’ statutory auditors—namely Deloitte & Associés and Grant Thornton—liable for faults and negligence committed in the performance of their duties.

To date, more than one thousand shareholders have expressed their interest in the Action.

The objective of the Action is to obtain compensation for the losses suffered by shareholders by demonstrating that Atos’ financial statements, as certified by its auditors, did not reflect the group’s actual financial and asset situation.

This case is of major strategic importance, as it is one of the largest civil actions ever brought against statutory auditors in France, relating to one of the most significant financial scandals on the Paris market.

2. Why is the Action directed against Deloitte & Associés and Grant Thornton?

Deloitte & Associés and Grant Thornton are the statutory auditors who certified the consolidated financial statements of the Atos group prior to the 2024 financial year. Based on our analysis, these statements can be considered inaccurate and misleading, which misled shareholders in their investment decisions in Atos shares.

The main faults and negligence alleged against Deloitte & Associés and Grant Thornton are as follows:

- Certifying financial statements that contained numerous irregularities and did not reflect the true financial and asset situation of the Atos group.

- Failing to issue a going concern warning, at the latest in relation to the 2021 and 2022 financial years.

3. What accounting irregularities have been identified?

The main accounting irregularities identified are as follows:

- The absence of impairment of intangible assets of the Atos group, particularly goodwill, despite a significant decline in cash flows and a substantial rise in interest rates affecting the discount rate (a key parameter in impairment testing);

- The failure to issue a going concern warning for the Atos group, particularly for the 2021 and 2022 financial years, despite an imminent liquidity risk concealed by aggressive working capital optimization measures, resulting in artificially inflated cash levels and reduced reported net debt;

- The aggressive recognition of assets related to multi-year contracts, which led to an artificial increase in balance sheet assets and equity, as well as an artificial increase in revenue on the income statement;

- The under-provisioning of certain risks related to the parent company's guarantees (off-balance sheet commitments) and the ongoing litigation between Syntel (a wholly owned subsidiary of Atos) and TriZetto in the United States;

- The reintegration of supposedly exceptional—but in fact recurring—expenses, which resulted in a misleading presentation of EBITDA.

4. Who can join the Action?

- In principle, any investor who acquired Atos shares between 21 February 2018 and 25 March 2024 (both dates included) is eligible to participate in the Action Against Atos Auditors, regardless of whether they were retained or sold afterwards.

- However, Atos employees who acquired shares through the company-sponsored employee investment fund (Fonds Commun de Placement d’Entreprise – FCPE) cannot directly participate in the Action, as they are not individually entitled to bring legal action. Only the FCPE’s management company is entitled to take such action. We are currently working on this issue.

- For free shares granted as part of remuneration (performance shares), the relevant reference date is the final vesting date of the shares, i.e., the date on which they are effectively delivered (settled) to the employee, and not the initial plan launch date. If you have sustained significant losses, please contact Vermeille & Co directly at contact@vermeille-avocats.com and attach the relevant supporting documentation (grant plans and proof of acquisition).

Registration on the platform dedicated to the Action does not automatically entail participation in the Action. Indeed, the effective participation of each investor will be assessed by the law firm Vermeille & Co, based on the expert reports prepared during the preparatory phase of the Action. The same applies to the amount of compensation sought in the context of the Action for the investors selected to participate.

5. How much does the Action cost? Do I have to pay out anything?

All procedural costs related to the conduct of the Action (lawyers’ fees, expert fees, court costs, etc.) are covered by a litigation fund that has agreed to finance the Action.

You therefore do not have to pay out anything to participate in the Action.

This funding covers the entire legal process (first instance, appeal, cassation, and remand after cassation) and is based on the following structure:

- If the Action is successful: a portion of the compensation awarded will be deducted by the fund, as detailed below;

- If the Action is unsuccessful: all costs covered by the fund will remain entirely at its expense.

In the event of a successful outcome, the amount deducted by the fund includes:

- reimbursement of a share of the procedural costs it paid, calculated in proportion to the compensation received by each participant in the Action;

- the cost of financing, amounting to 20% to 30% of the compensation received (depending on the duration of the proceedings);

- a success fee of 10% of the compensation received, paid to the law firm Vermeille & Co.

If the Action is unsuccessful, the claimants may be ordered to pay an indemnity covering the legal costs incurred by the opposing parties. The judge has full discretion to determine the amount of this indemnity, based on principles of equity and taking into account, among other factors, the respective financial situation of the parties, and the legitimacy and seriousness of the claims.

In the context of the Action, the fund has undertaken to cover any such indemnities up to an aggregate amount of EUR 100,000 for all claimants who are natural persons. This amount corresponds to the estimated level of risk in light of prevailing court practice.

6. How does the funding work?

The litigation fund finances the Action by acquiring your financial obligations (debts) towards the law firm Vermeille & Co:

- Step 1: You assign to the litigation fund your financial obligations (debts) towards the law firm Vermeille & Co, corresponding to legal fees and costs incurred for the defence of your interests (lawyers’ fees, expert fees, court costs, etc.). Vermeille & Co agrees to this assignment ;

- Step 2: The litigation fund will then pay these fees and costs directly to Vermeille & Co, which means you do not have to pay anything in order to take part in the Action.

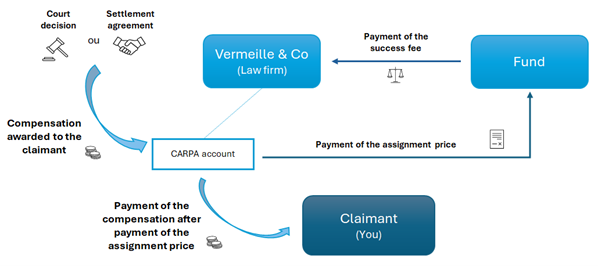

⇒ The following diagram illustrates these two steps:

What happens if the Action is successful?

- Step 1: If the Action is successful (final court decision or settlement agreement), the compensation awarded will be transferred to a secure account opened by the law firm Vermeille & Co with the CARPA (Caisse Autonome des Règlements Pécuniaires des Avocats – a French escrow account system managed by lawyers).

- Step 2: From this CARPA account, the litigation fund will receive the amount it is entitled to (as detailed in the answer to question no. 5 above), and the remaining balance will be transferred to your bank account.

7. How can I join the Action?

To participate in the Action Against Atos Auditors, you simply need to:

- Fill out the online form on the platform dedicated to the Action (by clicking the button below);

- Attach to the form the documents proving your acquisition of Atos shares between 21 February 2018 and 25 March 2024 (account statements or trade confirmations issued by your financial intermediary).

- Once your registration is validated, you will be required to electronically sign:

- The fee agreement with the law firm Vermeille & Co, authorizing it to represent your interests in the context of the Action;

- The agreement with the litigation fund, under which your financial obligations under the fee agreement (including legal fees, expert fees, court costs, etc.) are assigned to the litigation fund.

For a simplified presentation of these two agreements, please refer to the answer to question no. 8 below.

If you acquired Atos shares both in your own name and in the name of your company, you must complete two separate registrations on the platform (one in your name and one in your company’s name).

If your Atos shares are held in multiple accounts (e.g., securities account and French share savings plan (PEA), only one registration is required.

8. What documents do I need to sign to participate in the Action?

To participate in the Action, you will be required to electronically sign two agreements after completing your registration on the online platform (see the answer to question no. 7 for more information about the platform):

- The Fee Agreement (between you and Vermeille & Co)

This agreement includes, in particular:

- Your authorization for the law firm to represent you in connection with the Action;

- Your financial obligations for procedural costs (lawyers’ fees, expert fees, court costs, etc.), including a success fee payable in the event of a successful outcome of the Action;

- Your other obligations, including duties of information and cooperation.

- The Agreement with the Litigation Fund (between you, the litigation fund, and Vermeille & Co)

This agreement includes, in particular:

- The assignment to the litigation fund of your financial obligations (debts) towards Vermeille & Co (under the above fee agreement);

- The payment of procedural costs (lawyers’ fees, expert fees, court costs, etc.) by the litigation fund to Vermeille & Co, including the success fee in the event of a successful outcome of the Action;

- The financial consideration you will owe to the litigation fund in the event of a successful outcome, referred to as the assignment price.

9. How can I obtain a copy of my agreements?

Before signing the agreements, you may review and download them directly from DocuSign by clicking the download button on the right-hand side of the screen.

Once both agreements have been executed by all three parties, a copy will be sent to you automatically by email (delivery times may vary).

10. How does the procedure work and how long will it take?

The main steps of the legal procedure are as follows:

- Service of proceedings on Atos’ statutory auditors before the French Commercial Court;

- Conduct of the proceedings before the French Commercial Court (until the final ruling on the merits of the Action);

- Possible exercise of remedies (appeal before the French Court of Appeal and the French Court of Cassation);

- Final court decision;

- If necessary, enforcement proceedings to enforce the final court decision and recover the awarded compensation.

The duration of the proceedings is difficult to predict given the complexity of the Action, the uncertainty regarding appeals, and the possibility of a settlement that could bring the Action to an end at any stage of the judicial process.

You will be regularly informed of the progress of the proceedings via the platform dedicated to the Action.

11. Will I have to testify or attend a hearing?

No, you will not have to testify or attend any hearings.

All hearings, steps, and formalities will be handled by Vermeille & Co.

12. How will I be informed of the progress of the Action after registering?

After registering, you will regularly receive updates on the progress of the Action by email and/or via the platform dedicated to the Action.

You will find below the contact details of your key contacts:

- For legal questions relating to your personal situation: Vermeille & Co

atos@vermeille-avocats.com - For general questions about the Atos case:

news@atosauditaction.com - For technical questions about registration on the dedicated to the Action:

claims@atosauditaction.com